About > Our Journey

2024

After the closure of 3 Wilko units across our portfolio we were able to release them to B&M within 8 months.

Opening of Cranbrook Walk

Opening of Cranbrook Walk

2024

Opening of phase 2 at the Mall Wood Green NHS Community Diagnostic Centre

Opening of phase 1 AT Exchange Ilford 20,000 sq ft NHS

Repositioning of previous WH Smith stores into WingStop, Wendys and Pure Gym

Opening of phase 1 AT Exchange Ilford 20,000 sq ft NHS

Repositioning of previous WH Smith stores into WingStop, Wendys and Pure Gym

2023

$40m acquisition of Gyle Shopping Centre in Edinburgh

Sale of the Mall, Luton,

Sale of Redditch

Sale of the Mall, Luton,

Sale of Redditch

2023

Opening of CRATE food Hall in Walthamstow

Opening of Bridgelink food space in Wood Green

Opening of Bridgelink food space in Wood Green

2023

Construction commenced for new 20,000 sq ft NHS at Exchange Ilford

Relocation of TK Maxx at Exchange Ilford and opening in November, 2023

Relocation of TK Maxx at Exchange Ilford and opening in November, 2023

2022

Exchange and completion of Blackburn sale

Opening of NHS Community Diagnostic Centre in Wood Green

Opening of NHS Community Diagnostic Centre in Wood Green

2022

Completion of Walthamstow residential receipt and commencement of building

Opening of new Job centre at Exchange Ilford

Opening of new Job centre at Exchange Ilford

2021

Acquisition of Snozone Madrid

Rebrand of the Mall, Walthamstow to 17 & Central

Rebrand of the Mall, Walthamstow to 17 & Central

2021

The exchange and completion of Maidstone House office sale to local authority at Mall, Maidstone

Opening of a new Lidl supermarket in Luton

Opening of a new Lidl supermarket in Luton

2020

Securing planning consent in Walthamstow to incorporate new station entrance to Victoria Line underground at the heart of our Walthamstow scheme

2020

Exchanged conditional contracts with Long Harbour to deliver 495 residential units as Build to Rent

Completed on the sale of vacant land in Wood Green to Aitch Group

Completed on the sale of vacant land in Wood Green to Aitch Group

2019

The Marlowes refurbishment

Converted 14,000 sq ft vacant unit on the first floor to a Pure Gym

Converted the previous BHS to a 14,000 sq ft Pure Gym and 23,000sq ft Matalan

Converted 14,000 sq ft vacant unit on the first floor to a Pure Gym

Converted the previous BHS to a 14,000 sq ft Pure Gym and 23,000sq ft Matalan

2018

Opening of Flagship family precinct in Ilford

Refurbishment of New guest facilities at The Marlowes, Exchange Ilford, and WoodGreen (£2.1m)

Refurbishment of New guest facilities at The Marlowes, Exchange Ilford, and WoodGreen (£2.1m)

2018

Repositioning and refurbishment of the Mall, Maidstone and Exchange Ilford

Opening of Lidl and The Gym at Walthamstow

Opening of Travel Lodge at The Mall Wood Green

Opening of Lidl and The Gym at Walthamstow

Opening of Travel Lodge at The Mall Wood Green

2017

The Buttermarket Centre, Ipswich is sold to the National Grid Pension Fund for a price of £54.7 million at an equivalent yield of 5.9%.

2017

The Exchange Centre, Ilford is acquired from Meyer Bergman.

2016

The Mall Camberley is sold to Surrey Heath Borough Council.

2016

The Marlowes centre in Hemel Hempstead is acquired.

2015

C&R and Drum Property Group acquire the Buttermarket Centre in Ipswich.

The group completes disposal of it's German portfolio.

The group completes disposal of it's German portfolio.

2015

Dramatic internal refurbishment of The Mall Walthamstow is completed and work begins on refurbishment works for The Mall Maidstone.

2014

C&R converts to a REIT on 31st December 2014. The REIT regime enables Capital & Regional to benefit from a zero corporation tax rate on qualifying property income and capital gains.

2014

Acquisition of the Mall units completed with C&R now owning 100% of The Mall Fund.

2014

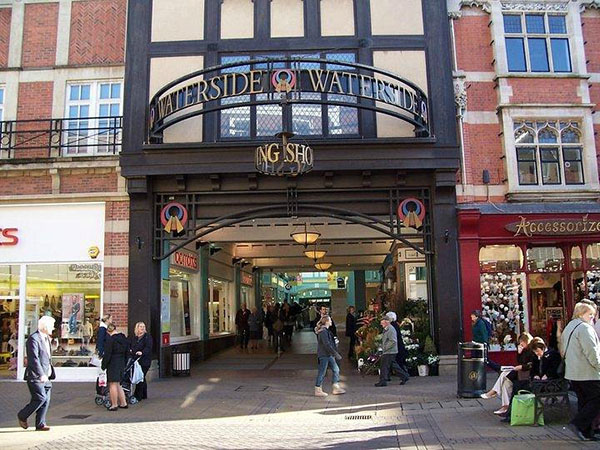

After successful completion of major development works the Waterside centre in Lincoln is sold to Tesco Pension Fund for consideration of £46.0 million at net initial yield of 5.88%.

2014

Sale of Jaman Fields in Hemel Hempstead to Tesco Pension Fund is completed.

2013

The Great Northern Warehouse in Manchester is sold, facilitating the Group to repay its last element of on balance sheet debt.

2013

Sutton Coldfield and Uxbridge shopping centres are sold.

2013

The Groups sells its 11.9% stake in the X-Leisure Fund and its 50% interest in X-Leisure Limited to a subsidiary of Land Securities Group plc

2012

The Group sells its 50% stake in Xscape Braehead to joint venture partners Capital Shopping Centres

2012

The Junction Fund is sold to subsidiaries of Hammerson plc

The Mall sells Norwich shopping centre

2012

C&R and Oaktree Capital Management purchase the 1 million sq ft Kingfisher Shopping Centre in Redditch

2012

The Group acquires additional units in The Mall Unit Trust. Group stake increased to 20.15% in The Mall Fund.

2011

The Mall sells Barnsley and Middlesbrough shopping centres

2011

The Junction sells Porstmouth Retail Park

2011

The Group purchases Waterside Shopping Centre in the Cathedral city of Lincoln

2010

Sale of the Group's office premises at 10 Lower Grosvenor Place, London and adjoining Beeston Place property

2010

The Mall sells Aberdeen, Preston and Ilford shopping centres

X-Leisure sells Grants, Croydon and Fiveways, Birmingham

The Junction sells Aylesbury and Hull retail parks

2010

Sale of the Group's 30% interest in Manchester Arena

John Clare appointed Chairman

Acquisition of 30% share in Garigal Asset Management GmbH

John Clare appointed Chairman

Acquisition of 30% share in Garigal Asset Management GmbH

2010

The Mall sells four shopping centres at Falkirk, Gloucester, Romford and Southampton

Restructuring of Mall bonds and extension of fund life to 2017

Restructuring of Mall bonds and extension of fund life to 2017

2009

£69 million placing and open offer, with Parkdev as anchor investor

£50 million rights issue in X-Leisure, alongside refinancing of banking facilities

Creation of X-Leisure Limited joint venture with Hermes

£50 million rights issue in X-Leisure, alongside refinancing of banking facilities

Creation of X-Leisure Limited joint venture with Hermes

2009

£64 million rights issue in The Junction with AREA as anchor investor

The Mall sells Bexleyheath shopping centre

The Junction sells Aberdeen and Slough retail parks

The Mall sells Bexleyheath shopping centre

The Junction sells Aberdeen and Slough retail parks

2009

X-Leisure sells the O2 Centre, Finchley Road, London

Sale of the remaining interest in the Cardiff joint venture

Sale of the remaining interest in the Cardiff joint venture

2008

Hugh Scott-Barrett appointed Chief Executive

The Mall sells three shopping centres at Epsom, Edgware and Chester

£286 million rights issue in The Mall

Sale of 50% of the German portfolio

The Mall sells three shopping centres at Epsom, Edgware and Chester

£286 million rights issue in The Mall

Sale of 50% of the German portfolio

2008

Sale of 80% of the FIX UK portfolio

The Junction sells Great Western Retail Park, Templars Retail Park and St George's Retail Park

Sale of the CostCo unit at Cardiff

The Junction sells Great Western Retail Park, Templars Retail Park and St George's Retail Park

Sale of the CostCo unit at Cardiff

2007

Cardiff development gains final approvals

The Junction sells Blackpole Retail Park, Worcester

The Junction sells Blackpole Retail Park, Worcester

2007

Sale of Xscape Milton Keynes and Castleford to X-Leisure

Acquisition of portfolio of six FIX UK properties

X-Leisure sells Star City

Acquisition of portfolio of six FIX UK properties

X-Leisure sells Star City

2006

Further acquisitions in Germany for €379 million

Sale of Morfa Shopping Park, Swansea to The Junction

Junction sells four secondary retail parks for a combined total of £159.8 million

Sale of Morfa Shopping Park, Swansea to The Junction

Junction sells four secondary retail parks for a combined total of £159.8 million

2006

The Mall raises a further £375 million with Mall bond tap issue

Acquisition of 30% interest in Manchester Arena

Purchase of four shopping centres from Prudential for £537 million

The Mall sells two of the four centres acquired from Prudential.

Acquisition of 30% interest in Manchester Arena

Purchase of four shopping centres from Prudential for £537 million

The Mall sells two of the four centres acquired from Prudential.

2005

The Junction purchases the Kittybrewster Retail Park in Aberdeen

The Mall acquires Main Square Shopping Centre in Camberley, Surrey

The Mall acquires Main Square Shopping Centre in Camberley, Surrey

The Junction purchases Telford Forge Retail Park and Slough Retail Park

The Mall Fund refinances £1.06 billion of bank debt

The Mall Fund refinances £1.06 billion of bank debt

2005

Formation of a joint venture with the German property group Hahn AG, one of Germany's leading co-investing property asset managers

Establishment of €110 million portfolio of eight out of town retail centres

Establishment of €110 million portfolio of eight out of town retail centres

Purchase of the T3 trade park portfolio, comprising 23 trade parks and ten industrial estates

Subsale of the ten industrial estates from the T3 portfolio

Subsale of the ten industrial estates from the T3 portfolio

2004

Sale of Glasgow Fort Shopping Park

The Mall purchases Eastgate Shopping Centre, Gloucester and The Junction purchases the Courts unit at Thurrock

The Mall purchases Eastgate Shopping Centre, Gloucester and The Junction purchases the Courts unit at Thurrock

Establishment of the X-Leisure fund, formed from the combination of three existing funds previously managed by MWB, valued at £500 million

The Junction purchases The Great Western Retail Park, Glasgow and sells Cockhedge Shopping Park, Warrington

The Junction purchases The Great Western Retail Park, Glasgow and sells Cockhedge Shopping Park, Warrington

2003

Partnership with AWG in respect of the Great Northern leisure and commercial development in central Manchester

Acquisition of the fund management business of Marylebone Warwick Balfour

Acquisition of the fund management business of Marylebone Warwick Balfour

The Mall purchases the Grosvenor Centre, Chester

The Junction purchases a portfolio of retail parks from Kingfisher for £696 million

The Junction purchases a portfolio of retail parks from Kingfisher for £696 million

2002

Partnership established with Pillar Property to develop Glasgow's first major shopping park

The Junction acquires four retail parks for £145 million, in Stoke, Thurrock, Ipswich and Warrington

Construction commences on the second Xscape in Castleford, Leeds

2001

Formation of two new property funds with Morley Fund Management Ltd. The Mall Fund, focused on in-town covered shopping centres, initially comprises 11 shopping centres.

The Junction Fund, focused on major retail parks, comprises 11 parks

2000

New Board structure announced: Tom Chandos appointed Chairman and Martin Barber Chief Executive

Company name changed from Capital and Regional Properties plc to Capital & Regional plc

1999

Announced re-designed corporate logo and moved to new offices

Acquisition of The Ashley Shopping Centre, Epsom and St Andrew's Quay Retail Park, Hull

1998

Started construction of Xscape in Milton Keynes

Acquired Westway Shopping Park, Greenford

Acquired Westway Shopping Park, Greenford

Acquisition of The Pallasades Shopping Centre, Birmingham

2 for 7 Rights Issue of 21.8 million new ordinary shares at 280p per share

2 for 7 Rights Issue of 21.8 million new ordinary shares at 280p per share

1997

Agreement to acquire the 75.1% interest in Lanham PLC which Capital & Regional did not already own

Acquisition of shopping centre portfolio for £147 million including The Howgate Shopping Centre, The Sauchiehall Centre, The Alhambra Shopping Centre, Selbourne Walk and Liberty 2

1996

£75.6 million of acquisitions made during the year including Shopping City, Wood Green

£26 million Convertible Subordinated Unsecured Loan Stock Issue

1995

£50 million spent on UK acquisitions (including joint venture acquisitions)

Creation of joint venture partnerships with JLW Finance

Moved to the Official list of the London Stock Exchange

Creation of joint venture partnerships with JLW Finance

Moved to the Official list of the London Stock Exchange

1994

£51 million spent on UK acquisitions, including Eldon Garden Shopping Centre, Newcastle

Rights issue raising £25.3 million

Rights issue raising £25.3 million

1993

£42 million spent on UK acquisitions, including The Trinity Shopping Centre, Aberdeen

Four share issues raising £17.9 million

Four share issues raising £17.9 million

Second joint venture partnership with PDFM Limited

US Flotation of CenterPoint as a publicly traded Real Estate Investment Trust (REIT) through $126 million offering

US Flotation of CenterPoint as a publicly traded Real Estate Investment Trust (REIT) through $126 million offering

1992

£14 million spent on UK acquisitions

Creation of joint venture partnerships with Securum and PDFM Limited

Creation of joint venture partnerships with Securum and PDFM Limited

1991

Placing and Open Offer to shareholders raising £5.7 million

Creation of joint venture partnership with Charterhouse Bank

Creation of joint venture partnership with Charterhouse Bank

1988

Sold 60% of UK portfolio

1986

Capital and Regional Properties was floated on the Unlisted Securities Market of the London Stock Exchange

1983

Formation of USA subsidiary, CenterPoint Properties Corporation, Illinois

1979

Capital and Regional Properties was formed in 1979

![240411_Pretty_Decent_Central_and_17_Launch_[_Chris_Coulson]–90 240411_Pretty_Decent_Central_and_17_Launch_[_Chris_Coulson]–90](https://capreg.com/wp-content/uploads/2024/08/240411_Pretty_Decent_Central_and_17_Launch__Chris_Coulson-90.jpg)